What to do if you suspect fraud on your account or debit card

- Contact us immediately at the number on the back of your debit card.

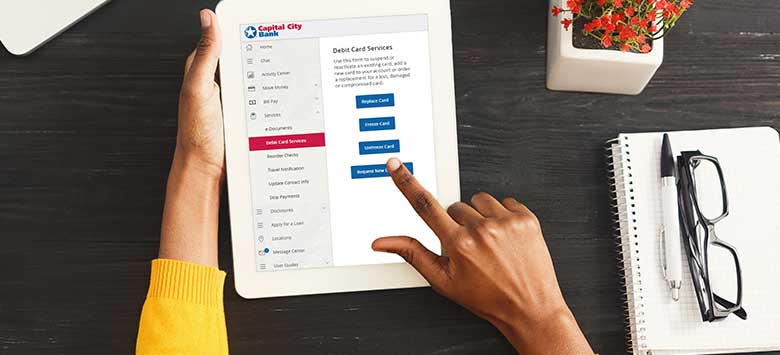

- Turn off your debit card from within your online banking account to stop additional unauthorized transactions. From your online/mobile banking menu, choose Services > Card Controls.

- Other services you might need that you can access from your online/mobile banking menu:

- Stop Payment - Request a stop payment on paper checks by choosing Services > Stop Payment.

- New Debit Card - Place an order for a new debit card by choosing Services > Debit Card - Order.

- Account Security Alerts - Opt in to receive notification immediately when changes are made to your account by choosing Settings > Alerts.

- Transaction Alerts - Opt in to receive notification immediately when your card is used internationally or in card-not-present transaction and decide whether to allow or block certain transaction types by choosing Services > Card Controls.

Your account or debit card has been compromised. Now what?

- We may replace your card, even if there is no indication it has been misused, as a precaution to ensure the safety of your account and personal information.

- Your replacement debit card will arrive in the mail within a few days and will include activation instructions.

- Once you've activated your replacement card, destroy your old card.

- If you have recurring debits from your debit card, such as car or insurance payments, you will need to notify these companies of your new number as soon as possible. Conversely, you do not need to worry about payments from your online banking or checking account - payments from your online banking or checking account will not be affected unless your account is closed.

How we protect you from fraud

Your security is our priority, and we employ multiple layers of safeguards to protect your account and ensure a secure banking experience. While we are taking every measure possible to safeguard your account, your online and mobile banking service offer several tools you can take advantage of to guard against fraud now and in the future.

Protecting your accounts and personal information from scams

The security and confidentiality of your personal information is important to us. That's why Capital City Bank will never call, text or e-mail you and ask for your debit card PIN or online banking password to verify or authenticate your identity. In fact, there is no legitimate reason any financial institution would ever need your debit card PIN or online banking password. For a scammer, on the other hand, it's the payday they're after.

Your safest bet, if you're ever contacted and asked to provide sensitive account or personal information, is always to hang up and call us directly to verify, unless you initiated the contact or are otherwise certain about the legitimacy of the person contacting you. In the event you receive a suspicious call, text or e-mail, or notice activity you don't recognize in your online banking transaction listing, our bankers are here to take immediate action to help protect you and your accounts from further exposure.

Call 888.671.0400 to be connected to our fraud protection services department 24 hours a day, seven days a week.

Card Service Hours:

- Monday through Friday 8 a.m. until 7 p.m., ET

- Saturday 9 a.m. until 4 p.m., ET

- Sunday 1 - 4 p.m., ET

- If calling outside of Card Service hours, a block will immediately be placed on your card to prevent all future transactions.

Don't take the baitPhishing scams may try to convince you otherwise, but Capital City Bank will never call, e-mail or text you to ask for sensitive information such as login credentials, account numbers, Social Security numbers or Secure Access Codes. Learn to spot and avoid the latest scams in our Fraud Alert Center.

|

|

|

Protect your account with a strong passwordTurn a memorable sentence into an acronym to make your password stand stronger against fraud. Learn more tips and tricks in our password dos and don'ts below. |

- Log into your online banking service or CCBMobile app.

- Under the main menu, click Services then Card Controls.

- Choose the affected debit card from the drop-down box and click Freeze Card.

- Be suspicious of anyone calling, e-mailing or texting you and asking you to provide your online banking username or password, or any numbers associated with your accounts, debit cards and personal identity, even if they claim to be calling from your bank. Do not provide any personal information, and contact us immediately to report the incident.

- Check your Capital City Bank statements on a monthly basis to ensure they match your records.

- Shred all personal and financial information before discarding.

- Never leave receipts at an ATM, at bank counters, etc.

- Remove mail from your mailbox promptly and deposit outgoing mail at a post office.

- Review your credit report annually. You are entitled to a free credit report every year.

- Set up account alerts in your online banking service to receive real-time notification when specified transactions and security events occur.

Enlist your mobile phone and e-mail in the battle against debit card fraud!

- Call us.

- Chat with us.

- Log in to your online banking service or the CCBMobile app. From the Main Menu, select Services > Update Contact Information to verify your mobile phone number is listed in the Cell Phone field, e-mail address in the Email field, or update or add a mobile number or e-mail to your account.

Get the most out of your fraud protection service

disruption when using your debit card with these tips:

- Always use the electronic chip versus the magnetic strip – the electronic chip is

more secure and less likely to be flagged. - When making purchases on your card, always have your phone handy so you can

receive and respond to any alerts we might send. - Respond as soon as possible to avoid any disruption in debit card use. However,

you can respond up to 72 hours after receiving an alert. If it's been longer than 72

hours, contact your banker or our Client Service Center for assistance. - When traveling, it’s always good practice to notify your financial institution when

you’ll be using your debit card outside of an area that’s normal for you. Additionally,

keep in mind that fraud alerts rely on text and phone access, so consider an

international calling plan when traveling abroad to ensure you are able to receive

and respond to alert texts and phone calls.

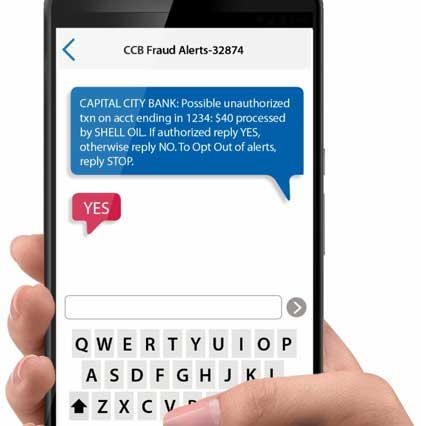

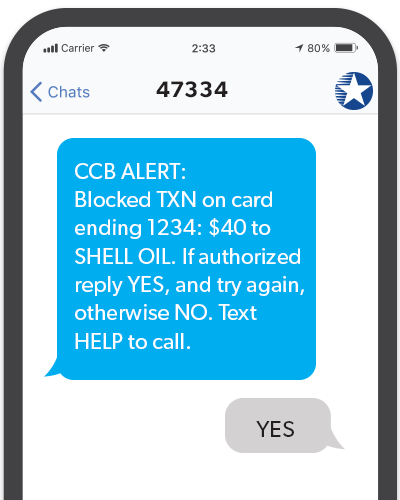

Capital City Bank places fraud rules to protect our clients and the Bank. Clients are able to indicate, through text responses, whether they made a recent transaction or not, allowing more control of the transactions that occur on their debit cards.

When suspicious transactions are flagged, Capital City sends text message and e-mail alerts when fraud or possible fraudulent activity is suspected. Clients with a current mobile phone number listed will receive an SMS text message in real time from sender 47334.

Depending on the situation at hand, you will receive a text and/or e-mail that your transaction attempt was blocked or a possible unauthorized transaction has occurred.

- Blocked transaction, reply YES and attempt your purchase once again. Or, reply NO if you did not authorize the transaction to let us know it is fraud.

- Possible unauthorized transaction, you simply reply YES or NO. We handle all the rest. In certain cases, your card may be temporarily deactivated. Once you reply YES your card will be reactivated.

- If the activity is unauthorized, reply NO to let us know it is fraud, and we will instantly deactivate your debit card to block future fraudulent transactions.

- If you do not wish to receive alerts about suspected incidents of financial or identity fraud, you can cancel text messaging services at any time. Text STOP in response to any alert from your mobile device or by texting STOP to 47334. Clients who do not have a cell phone on file, or opt-out of text alerts will receive a phone call from 866.446.1415 to validate a transaction. It is very important that cell phone and e-mail information on file be current and accurate.

- Opt back in to SMS fraud alert text messages by texting CCBG to 47334.

- Why? It is common for thieves to add stolen cards to digital wallets, so we want to verify for your protection.

- What’s next? If you did add your debit card to a digital wallet, respond YES to the alert you receive to continue using your card without interruption.

- Why? Because as soon as the preauthorization clears, the real charge is assessed. Prompting you to verify at the time of preauthorization allows us to confirm with you before any money leaves your account.

- What’s next? If you did attempt an online payment or purchase at the listed merchant, respond YES to continue using your card without interruption.

In the event we flag a suspicious transaction, we take one of two actions to secure your account until we hear from you. All fraud alerts require a quick reply of YES or NO, and our systems process your reply immediately so it only takes seconds.

Below and the types of CCB Alerts you might receive and how to respond:

| DO | DO NOT |

|---|---|

|

|

- Keep all identifying information in a secure place in your home. Never carry Social Security cards or other important documents such as passports or birth certificates in your purse or wallet.

- Double-check monthly statements to ensure they match your records.

- Shred all personal and financial information before discarding it.

- Do not share account numbers or other personal financial information over the telephone or Internet unless you initiated the interaction.

- Review your credit report annually. You are entitled to a free credit report each year from one of the three main credit reporting bureaus.

P.O. Box 740241

Atlanta, GA 30374

800.685.1111

P.O. Box 1000

Chester, PA 19022

800.888.4213

P.O. Box 2002

Allen, TX 75013

888.397.3742